Medicare

Medicare is a way to pay for your health insurance in retirement. You want to make the best decision for you and your overall retirement plan and health. At Senior Resource Center, we make it easy to understand! Call us for a free consultation.

What is Medicare?

- Health Insurance for:

- People 65 years of age and older

- People under age 65 with certain disabilities

- People of all ages with End-Stage Renal Disease

- Run by the Centers for Medicare & Medicaid Services (CMS)

- Augmented by Private Insurance Companies

- Sign up with the Social Security Administration or Railroad Retirement Board

What is Medicare?

- Health Insurance for:

- People 65 years of age and older

- People under age 65 with certain disabilities

- People of all ages with End-Stage Renal Disease

- Run by the Centers for Medicare & Medicaid Services (CMS)

- Augmented by Private Insurance Companies

- Sign up with the Social Security Administration or Railroad Retirement Board

When Can You Enroll in Medicare?

Turning 65 -

7 Month Period

3 months before Birth Month/Birth Month/3 months after Birth Month.

Coverage starts on the 1st of Birth Month (or the 1st of the next month if later)

Dropping Group Health

After 65 Years Old

Within 63 Days of dropping Group Health

Coverage starts 1st of the

next month.

General Enrollment Period (GEP)

January 1 – March 31

Coverage starts the month

after you enroll.

Turning 65 -

7 Month Period

3 months before Birth Month/Birth Month/3 months after Birth Month.

Coverage starts on the 1st of Birth Month (or the 1st of the next month if later)

Dropping Group Health

After 65 Years Old

Within 63 Days of dropping Group Health

Coverage starts 1st of the

next month.

General Enrollment Period (GEP)

January 1 – March 31

Coverage starts the month

after you enroll.

Turning 65 -

7 Month Period

3 months before Birth Month/Birth Month/3 months after Birth Month.

Coverage starts on the 1st of Birth Month (or the 1st of the next month if later)

Dropping Group Health

After 65 Years Old

Within 63 Days of dropping Group Health

Coverage starts 1st of the

next month.

General Enrollment Period (GEP)

January 1 – March 31

Coverage starts the month

after you enroll.

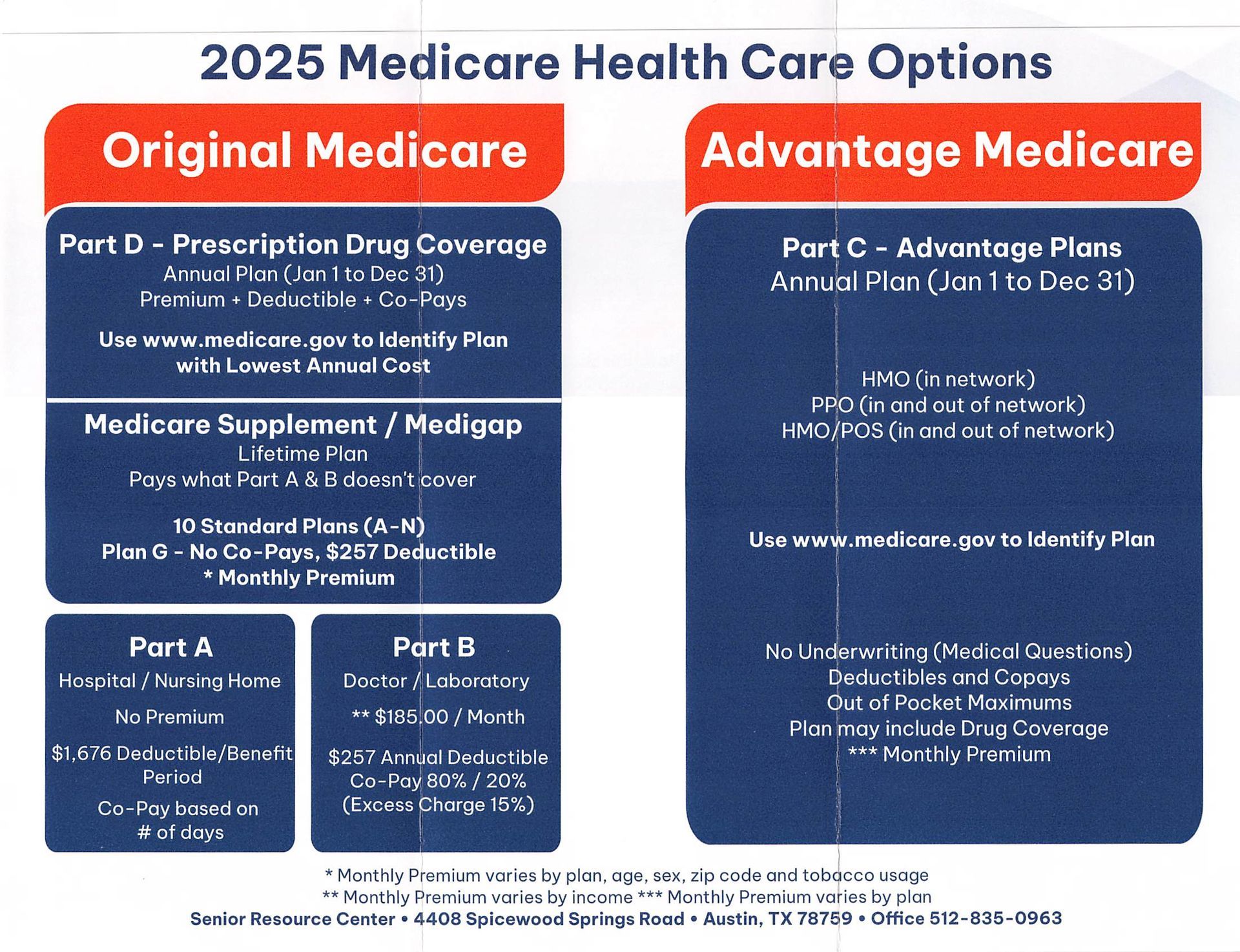

You Have 2 Choices for Medicare

Each choice has advantages and disadvantages, we can help you decide what is best for you!

- Original Medicare + Medicare Supplement + Part D RX plan

- Advantage Plan Medicare

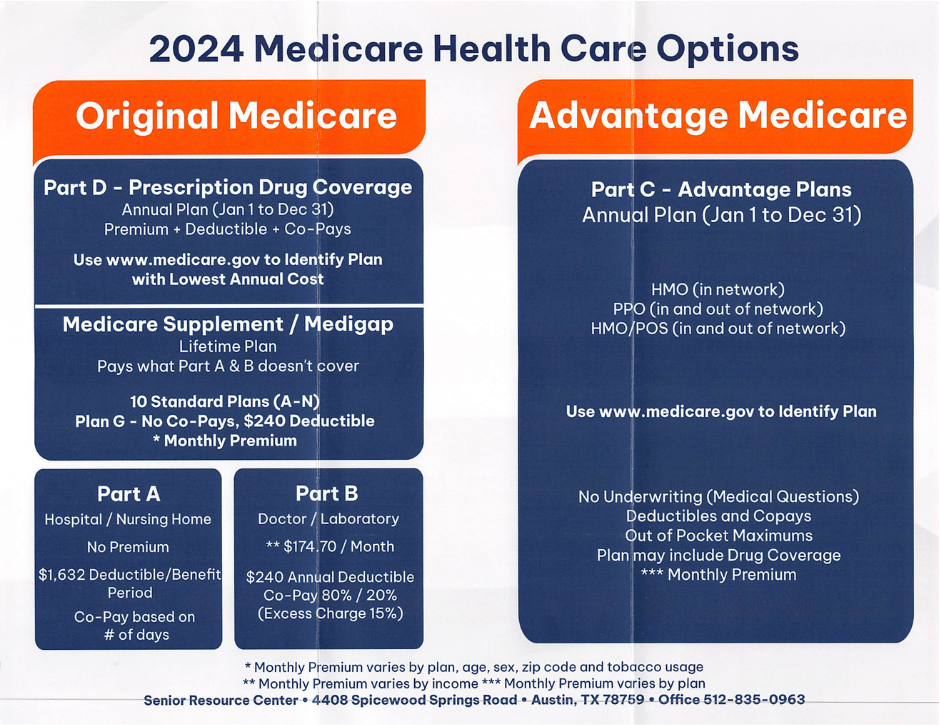

You Have 2 Choices for Medicare

Each choice has advantages and disadvantages, we can help you decide what is best for you!

- Original Medicare + Medicare Supplement + Part D RX plan

- Advantage Plan Medicare

You Have 2 Choices for Medicare

Each choice has advantages and disadvantages, we can help you decide what is best for you!

- Original Medicare + Medicare Supplement + Part D RX plan

- Advantage Plan Medicare

Your Medicare Options

Stay on Group Health

•Less than 20 Employees – Sign up for Medicare Parts A & B because Medicare is Primary

•20+ Employees – Sign up for Medicare Part A BUT not Part B because Group Health is Primary

Drop Group Health and Enroll in Full Medicare

•Sign up for Medicare Parts A & B

•Select a Medicare Supplement Plan (Medigap)

•Select a Part D Prescription Drug Plan

•OR Sign up for Medicare Parts A & B and Advantage Plan

Your Medicare Options

Stay on Group Health

•Less than 20 Employees – Sign up for Medicare Parts A & B because Medicare is Primary

•20+ Employees – Sign up for Medicare Part A BUT not Part B because Group Health is Primary

Drop Group Health and Enroll in Full Medicare

•Sign up for Medicare Parts A & B

•Select a Medicare Supplement Plan (Medigap)

•Select a Part D Prescription Drug Plan

•OR Sign up for Medicare Parts A & B and Advantage Plan

Your Medicare Options

Stay on Group Health

•Less than 20 Employees – Sign up for Medicare Parts A & B because Medicare is Primary

•20+ Employees – Sign up for Medicare Part A BUT not Part B because Group Health is Primary

Drop Group Health and Enroll in Full Medicare

•Sign up for Medicare Parts A & B

•Select a Medicare Supplement Plan (Medigap)

•Select a Part D Prescription Drug Plan

•OR Sign up for Medicare Parts A & B and Advantage Plan

Want to learn more

about Medicare?

Download your complimentary copy of our 2025 Understanding Medicare brochure and our 2025 Medicare Healthcare Options Guide to get information about your choices.

Want to learn more

about Medicare?

Download your complimentary copy of our 2024 Understanding Medicare brochure and our 2024 Medicare Healthcare Options Guide to get information about your choices.